AHL posted a recent client article, called Cooking up Sharpe: A Recipe for Portfolio Construction

It is a typical client facing article, where they talk about how one can improve the sharpe as well as returns of a 60/40 portfolio by adding a few things. They start by turning the 60/40 into a risk managed portfolio, which makes sense. You fix a vol target, then change the gearing as the market volatility fluctuates. Makes sense.

Key points from the article:

Diversify 60/40 by adding the following strategies:

Alternative trend (400 market set)

Volatility long/short

Equity Market Neutral

Inflation Linked Securities

Gear up by exploiting the cash efficiency of derivatives as well as the low correlation between strategies, by about 2x

Risk Management which is really just adding a few additional defensive strategies, which are:

Traditional trend (core markets)

Long/Short Quality (cash equities)

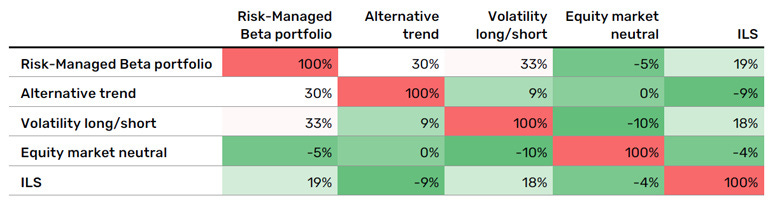

Step 1, Diversification makes sense, given the relatively low correlation of strategies. I am somewhat intrigued by the choice of strategies here. I believe these additional strategies are based on what’s available at AHL rather than a larger set of potential strategies that is available to any sophisticated investor.

From the article:

The problem with the article is that the details on what these strategies include is very scant. For example, I have no idea what they mean by Equity Market Neutral. Are we talking about something like a factor portfolio that trades the Carhart 4-factors, plus Stat Arb? I guess so, but again we do not know if that’s the case.

Likewise, the volatility long/short strategy is a bit of a black box. There are many different strategies one can apply and call it a vol long/short strategy, however, seeing that there is a high correlation (30%) between the Vol and the beta portfolio, we can see that the vol strategy has a long bias. Therefore I believe we are looking at a strategy that has a heavy emphasis on collecting premiums, such as short straddles or other option spreads. These strategies collect embedded premium by being short theta (i.e. make money from time decay) and short vega (i.e. make money from implied vol decaying to realized vol).

It is somewhat surprising that the alt trend shows a 30% correlation to the beta portfolio. This would make sense if the underlying market set were comprised of high carry, high embedded premium markets such as CDS indices, corporate bonds, EM FX etc. Since the trend signals are calculated on total returns, over longer time horizons (this is key!) the trend signal may pick up on carry especially if carry is high. There are ways to neutralize such long bias, but I also understand that strategy owners would not want to create a negative carry portfolio in doing so.

ILS strategy including catastrophe bonds is a little odd, as they are different beasts. I can understand these instruments being bucketed together from a premia perspective.

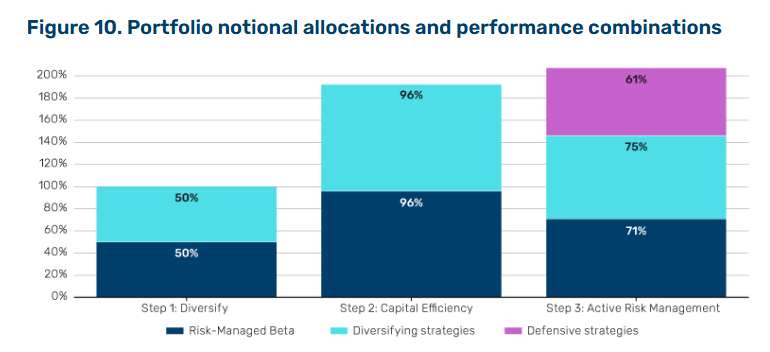

Step 2 involves gearing up the portfolio. I believe the outcome of steps 1 and 2 are highly correlated (>95%), and the only impact is achieving higher returns at higher volatility at the same sharpe.

Step 3 is where things start to get weird and somehow fall apart for me. What they call active risk management is actually not risk management in the true sense of the word. They are adding defensive strategies that tend to have negative correlation to the existing strategies added in step 1, especially when stuff hits the fan. Therefore, they add classic trend following and the equity quality factor here, the idea being they want the downside protection without paying the premium. The obvious downside of such strategies is that their convexity of returns are highly dependent on certain market conditions being met. For example, trend strategies performed very poorly when the SVB episode happened in March 2023, since they were very short bonds at that point and they did not have an opportunity to alter their positions. It’s a bit rich to call these strategies active risk management, but I get the concept.

After Step 3, the risk allocations show a roughly equal split between 60/40 beta portfolio, diversifying strategies and the “defensive” strategies. I believe the classical and alternative trend following strategies would have meaningfully positive correlation around 50-60%. This increases the overall trend following exposure through a backdoor perhaps, but it’s not really a bad thing. Adding more trend following to the book smooths out the ride for holding an equity heavy portfolio (let’s be real, 60/40 notional allocation is 80 to 90% risk allocation in equities) especially in years like 2008 and 2022.

Obviously AHL is talking their own book here, but the conclusions are solid. I wish they provided a bit more detail on what each strategy was, without giving away too much of the secret sauce.

Also, investors should be aware of what other strategies might be out there that are not correlated to these building blocks. Price based strategies trading on shorter time scales, or systematic macro relative value strategies are likely going to be very additive to the strategy set here.